bad debt recovery

Since those invoices were already written off and the books have been closed for that specific period there are two. Bad Debt Recovery is a debt from a loan credit line or accounts receivable that is recovered either in whole or in part after it has been written off or classified as a bad debt.

Bad Debt Recovery Free Of Charge Creative Commons Clipboard Image

In other words it represents any settlement from debtors after being considered a.

. How Does Bad Debt Recovery Work. Bad debt recovery is the money that your business receives after writing it off as uncollectable. Lets assume that Company XYZ sells 1000000 worth of goods to 10 different customers.

Bad debt recovery is an attempt to secure a partial or full payment of a debt that has been written off due to non-payment. 10 hours agoTherefore there is no bad debt of Rs229995- which was written of f but it was short recovery of payments on which interest is chargedas there was no financial transactions. Bad debt recovery.

Bad debt is debt that is not collectible and therefore worthless to the creditor. Thanks for getting back to us lmoran. Businesses sometimes conduct this type of activity.

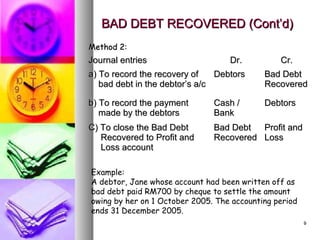

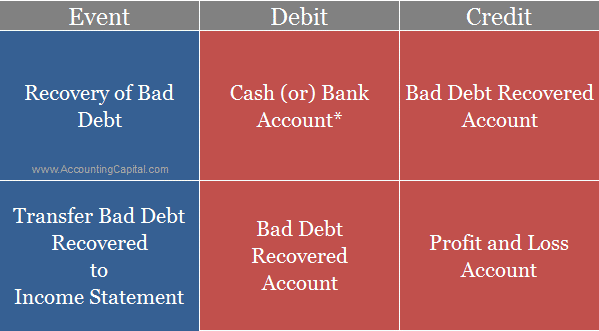

A business had previously written off a bad debt of 2000 using the allowance method for bad debts but has now managed to make a bad debt recovery and has received. Bad debt recovery refers to a payment that companies receive for a debt written off as bad. Debt Recovery Service can produce income because it will typically generate a loss when it is.

With so many new collecting agencies it can be. Bad debt is money that is owed but cannot be collected. Methods of Bad Debt Recovery.

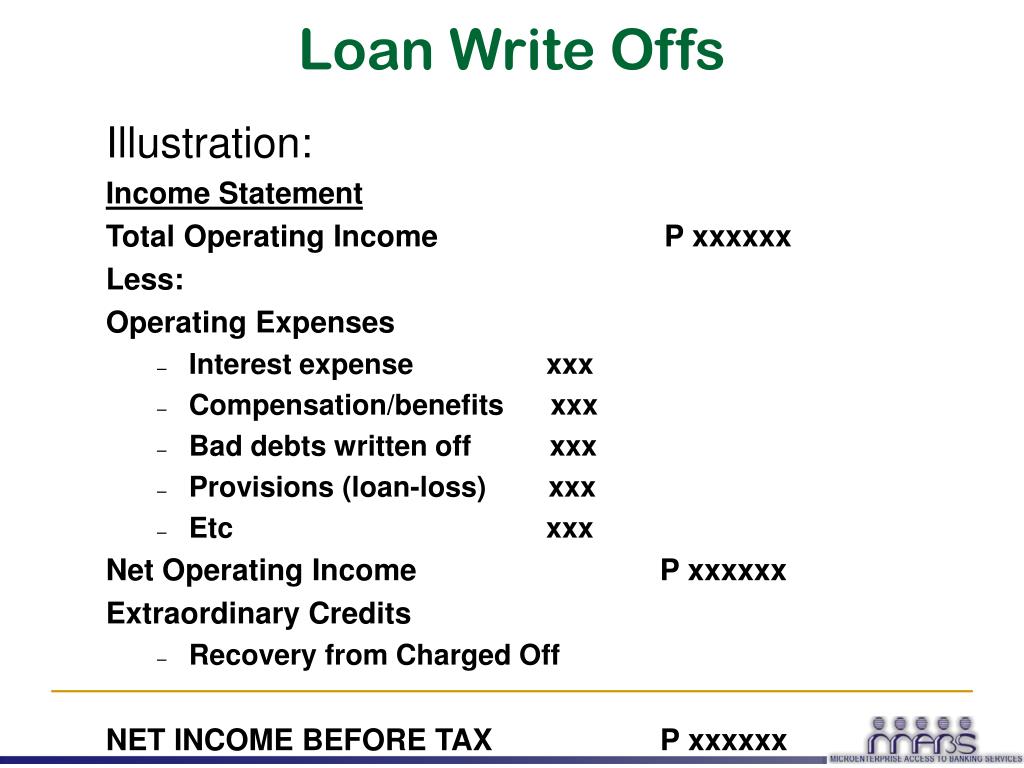

Bad debt is usually a product of the debtor going into bankruptcy but may also occur when the. A compassionate but firm approach to debt collection that does not jeopardise a clients existing business. The bad debt recovery process starts when the borrower cannot pay back the.

Third-party bad debt recovery services can manage. Company XYZ records 1000000 in. It is a process of collecting a debt after it has been written off or classified as a bad debt.

Bad debt recovery is the payment received that was previously written off against a companys receivables. As the bad debt creates a loss for the company initially when. Bad debt recovery occurs when partial or full payment is received for a loan deemed uncollectable.

Bad debt recovery is the process of locating and contacting debtors validating and reporting on debts and establishing payment plans. This type of recovery. As a result of individuals and businesses seeking debt relief we are seeing a larger investment in the number of debt collecting agencies.

The recovery of bad debts is done through a lawsuit at a court or arbitration or coordinating with the authorities to force the debtors to fulfill their debt repayment obligations.

Journal Entry For Recovery Of Bad Debts Accountingcapital

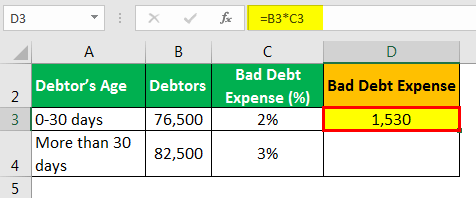

Bad Debt Expense Formula How To Calculate Examples

Print Gst Bad Debt Relief Estream Software

Ppt Management Of Hardcore Delinquent Accounts Powerpoint Presentation Id 5893463

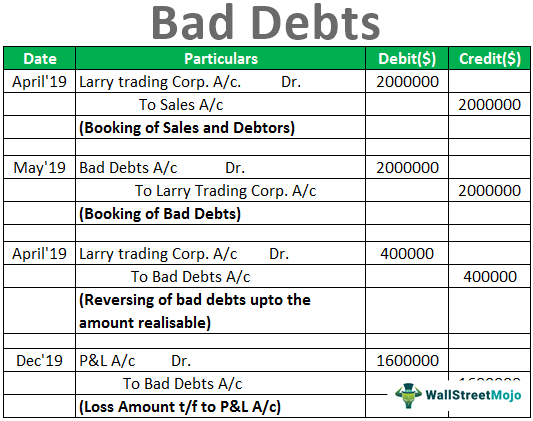

Bad Debts Meaning Example Accounting Write Off

Writing Off An Account Under The Allowance Method Accountingcoach

Bad Debt Bad Debt Recovery Gegi Customer Care

Debt Collection Software Solution For Recovery Automation Leadsquared Debt Collection Business Infographic Debt Recovery

What Is The Journal Entry For Bad Debts Recovered Quora

Bad Debt Bad Debt Recovery Gegi Customer Care

How To Recover Bad Debts By Dubai Debt Recovery Issuu

Early Out Vs Bad Debt In The Collections Industry Capital Recovery

Recovering Bad Debt For Clients On Vimeo

Five State Banks Register 8 89 Bad Debt Recovery Against Target

Bad Debt Bad Debt Recovery Gegi Customer Care

Comparison Of The Performance Of Several Data Mining Methods For Bad Debt Recovery In The Healthcare Industry Semantic Scholar

Cmre Medical Bad Debt Recovery

What Are Bad Debt Recovered Example Journal Entry Tutor S Tips